Summary Sales Receipt to Record Nonprofit Income

Summary sales receipts have long been a “go to” accounting trick for restaurants and retail stores. By using a summary sales receipt, a business can easily enter a summary of the day’s sales and methods of payment into the accounting system. But did you know this technique can also be used by nonprofits?

Summary sales receipts have long been a “go to” accounting trick for restaurants and retail stores. By using a summary sales receipt, a business can easily enter a summary of the day’s sales and methods of payment into the accounting system. But did you know this technique can also be used by nonprofits?

How a Sales Summary Works

A summary sales receipt is a single transaction entered into the accounting software to summarize sales for a period of time, usually one day, but can also be weekly or monthly. It can be especially helpful for nonprofits that use separate software to manage customers and sales as we described in last week’s post, Getting Income from Customer Management Software into QuickBooks.

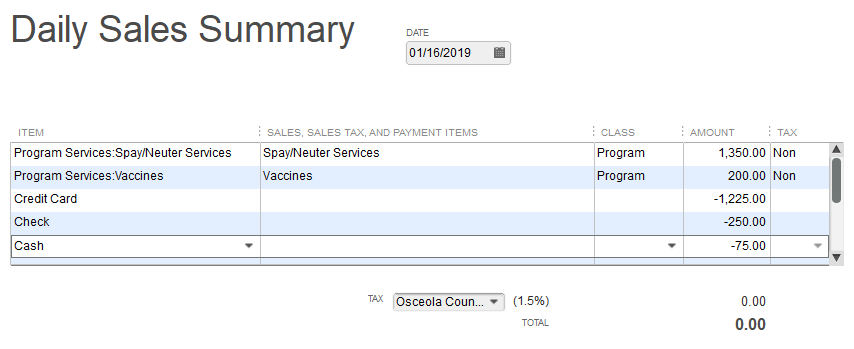

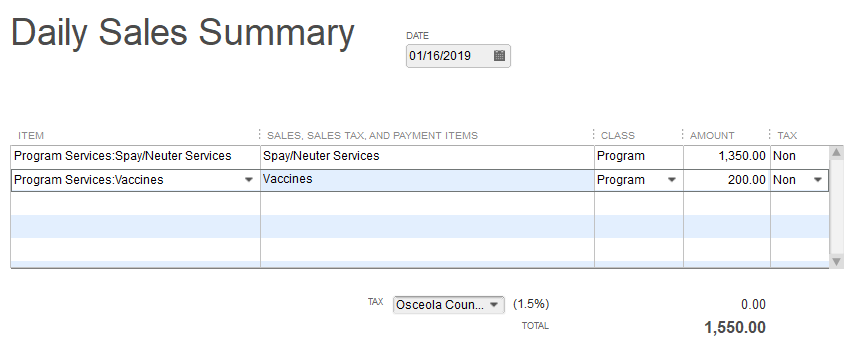

The way it works is straightforward. First you batch sales for a period of time, say one day. Then you enter those sales into QuickBooks (or other accounting software) as you normally would using a sales receipt.

Next you enter customer payments into the same sales receipt broken out by payment method as negative amounts.

Next you enter customer payments into the same sales receipt broken out by payment method as negative amounts.

The sum of the sales and the payments should equal zero.

Where do these amounts go?

When you create a sales receipt in QuickBooks Desktop or Online, you do not assign amounts directly to an account in the chart of accounts. Instead you select an item (in Desktop) or a product/service (the equivalent in Online) and that is what links to the account. Therefore proper setup of items (we’ll refer to products/services as items also) is of paramount importance.

In the sales receipt above, the program service items for Spay/Neuter Services and Vaccines link directly to income accounts for program service revenue. The payment items record the forms of payment for those sales.

QuickBooks Desktop software has a handy item type called Payment. If you set up a Payment type item, you can define the name of the item, such as “Check,” and select where you want that payment to go – such as to the Undeposited Funds account or directly to a bank account. This makes it easy to set up payment type items for all forms of payment such as:

- Cash

- Check

- eCheck

- Visa/MasterCard

- Amex

- Discover

- Money Order

- PayPal

And so forth. Then you can select these Payment type items on your summary sales receipt to indicate all the ways customers paid for the related sales.

Of course the reason you want to track the payment types separately is because they are deposited differently. Cash is taken to the bank. Checks may be taken to the bank or deposited remotely. Credit card payments are processed then deposited by your merchant bank processor. PayPal payments are deposited directly into your account with PayPal. The Payment type items let you define the best account for recording that particular type of payment.

Unlike QuickBooks Desktop software, QuickBooks Online does not have Payment type items. But never fear; we have a work around so you can still use a Sales Summary Receipt in QuickBooks Online.

Using a Sales Summary Receipt in QuickBooks Online

Keeping with our simple example, say the vet office only takes cash, checks and credit card payments. They can set up bank feed rules in QuickBooks Online so all deposits that download with “DEPOSIT” in the description are automatically posted to a Cash/Check Clearing account and all deposits that download with “BANKCARD SETTLEMENT” in the description are automatically posted to a Credit Card Clearing account. The clearing accounts are set up as bank accounts, but they merely serve to offset the deposit to the operating account.

Now you can create product/service items that link to these clearing accounts. Make them Service type items. (Recall the Payment type item does not exist in QuickBooks Online.) The Cash/Check Payment item would link to the Cash/Check Clearing account and the Credit Card Payment item would link to the Credit Card Clearing account.

Now create your Summary Sales Receipt as usual, and pick the items you just created to enter customer payments as negative amounts. The payments will be recorded to the clearing accounts and will offset the original downloaded deposits that were posted there.

A Few Tips

In reality Summary Sales Receipts can get a bit more complicated. It’s handy to create an Over/Short item that links to a Miscellaneous Expense account for those times when the payments are a little off from sales. You can also create items for scholarships or other fee waivers if the “payment” is in the form of a discount on the amount owed.

Sales tax is another complicating factor. If some of your sales are subject to sales tax, you need to make sure the income items are marked appropriately as taxable or not and that the proper tax rate is used. QuickBooks will calculate the tax due regardless of what you collected.

Overall, the use of a Summary Sales Receipt can be an excellent way to enter summarized income such as sales or donations and the related customer payments. A Summary Sales receipt is especially handy if you don’t need or want all the transaction detail in QuickBooks or if the software you use for invoicing and tracking customer payments does not integrate easily or at all with QuickBooks.